The insiders hold 8.50% of the company’s shares while institutions hold 55.00%. Current shares outstanding are 1.57 billion. (NYSE:SNAP), we note that the average 3-month trading volume was 33.25 million, while that of the preceding 10-day period stands at 28.44 million. In contrast to these companies, both the S&P 500 Index and the Dow Jones Industrial were at 0.56% and 0.41%, respectively, at close of the trading.Ĭoming back to Snap Inc. (GOOGL) was also down -0.15% in the last session, while its price remained in the red at -23.75% over the same period.

Another of its peers Microsoft Corporation (MSFT) has gained 1.05% previous session, and was -6.32% down over the past year, while Alphabet Inc. (AAPL), which has seen its stock price rise 0.83% in the last trading session and was -5.85% over the last one year.

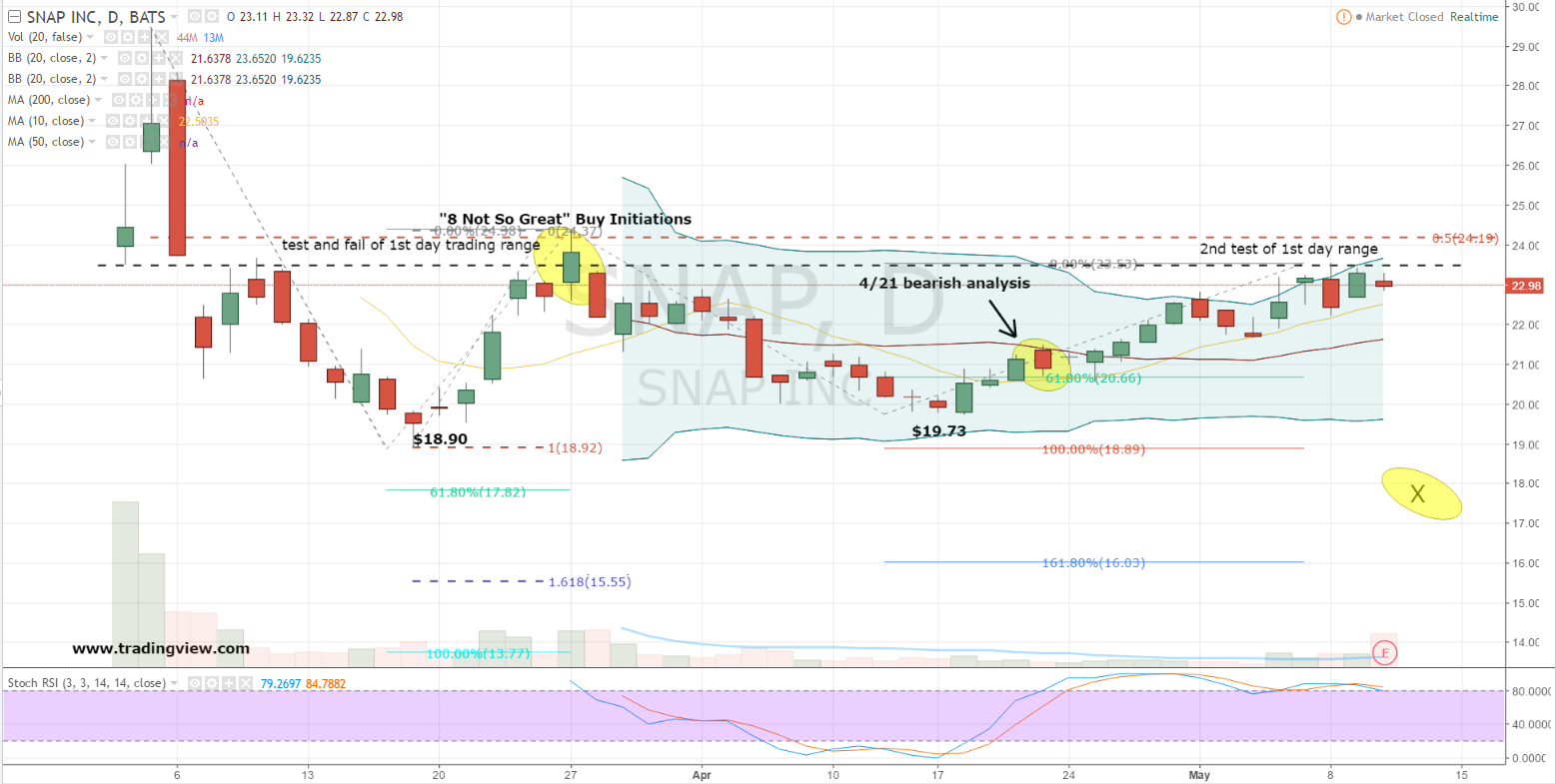

We find that current price change of 1.49% and -67.78% over the past 12 months for SNAP competes that of Apple Inc. Long term indicators on average place the stock in the category of 50% Buy. On the other hand, looking at the outlook for the SNAP stock, short term indicators assign the stock an average of 50% Buy, while medium term indicators assign it an average of 50% Buy. There have been 1 upward and no downward revisions for the stock’s EPS in last 7 days, something that reflects the nature of company’s price movement in short term. According to analyst consensus estimates figures, the company’s yearly revenue forecast for 2023 is expected to hit $4.72 billion, or 2.60% up from figures reported last year. The median projection represents growth adding up to -5.30% compared to sales growth for the corresponding quarter a year ago. These figures represent 47.10% and 52.00% growth in EPS for the two years respectively.Īnalysts tracking the company’s growth have also given it a consensus growth in revenue estimated at $1.01 billion, with a low of $983.4 million and a high of $1.04 billion. Estimates by analysts give the company expected earnings per share (EPS) of $0, with the EPS growth for the year raised at $0. has a market cap of $18.01 billion and is expected to release its quarterly earnings report on – Apr 24, 2023. Don't wait - get our free report today!ĭownload Your FREE Green Energy Report & Unlock Your Investment Potential Today! Get the best of both worlds with multiple salt dome opportunities in the green hydrogen space and precious metals development. Invest in the Green-Energy Revolution now with our free report! Discover small-cap mineral exploration companies set to be the next suppliers of green energy. Act Now and Secure Your Future in Green Energy!

0 kommentar(er)

0 kommentar(er)